Contents

- Narrative Report for the Statement of Accounts 2020 to 2021

- Responsibilities for the Statement of Accounts

- Independent Auditor's Report to the Members of London Borough of Bexley

- Comprehensive Income and Expenditure Statement

- Movement in Reserves Statement

- Balance Sheet

- Cash Flow Statement

- Notes to the Accounts 1 to 10

- Notes to the Accounts 11 to 20

- Notes to the Accounts 21 to 30

- Notes to the Accounts 31 to 42

- Collection Fund

- Group Accounts

- Pension Fund Accounts 2020 to 2021

- Annual Governance Statement 2020 to 2021

- Glossary

Pension Fund Accounts 2020 to 2021

Statement of Responsibilities for the Pension Fund Accounts

The Council is required to make arrangements for the proper administration of its pension fund affairs and to secure that one of its officers has the responsibility for the administration of those affairs. That officer in this Council is the Director of Finance and Corporate Services who has the Section 151 Officer’s Responsibilities. Also, it is required to secure the economic, efficient and effective use of resources and safeguard its assets. The Council is also required to approve the Pension Fund Accounts.

The Director of Finance and Corporate Services is responsible for the preparation of the Pension Fund Accounts in accordance with proper practices as set out in the CIPFA Code of Practice on Local Authority Accounting in the United Kingdom (‘the Code’).

In preparing the Pension Fund Accounts, the Director of Finance and Corporate Services has:

- Selected suitable accounting policies and applied them consistently.

- Made judgements and estimates that were reasonable and prudent.

- Complied with the Code of Practice.

Also, the Director of Finance and Corporate Services has:

- Kept proper accounting records that were up to date.

- Taken reasonable steps for the prevention and detection of fraud and other irregularities.

The Statement of the Director of Finance and Corporate Services

The required financial statements for the Pension Fund appear on the following pages and have been prepared in accordance with the accounting policies set out in 3. Accounting Policies.

The Pension Fund Accounts present a true and fair view of the financial position of the Pension Fund at the accounting date and its income and expenditure for the year ended 31 March 2021.

Paul Thorogood

Director of Finance and Corporate Services

Date: 9 February 2022

I confirm that the 2020/21 Statement of Accounts for the London Borough of Bexley and Bexley Pension Fund were approved by the General Purpose and Audit Committee on 30 September 2021.

Cllr Peter Reader

Chair of the General Purposes and Audit Committee

Date: 9 February 2022

Auditor’s Report to a LGPS Administering Authority – Report on Pension Fund Financial Statements

Independent Auditor’s Report to the Members of London Borough of Bexley

Opinion

We have audited the pension fund financial statements for the year ended 31 March 2021 under the Local Audit and Accountability Act 2014. The pension fund financial statements comprise the Fund Account, the Net Assets Statement and the related notes 1 to 24. The financial reporting framework that has been applied in their preparation is applicable law and the CIPFA/LASAAC Code of Practice on Local Authority Accounting in the United Kingdom 2020/21.

In our opinion the pension fund financial statements:

- give a true and fair view of the financial transactions of the pension fund during the year ended 31 March 2021 and the amount and disposition of the fund’s assets and liabilities as at 31 March 2021; and

- have been properly prepared in accordance with the CIPFA/LASAAC Code of Practice on Local Authority Accounting in the United Kingdom 2020/21

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of our report below. We are independent of the pension fund in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard and the Comptroller and Auditor General’s (C&AG) AGN01, and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the Director of Finance and Corporate Services’ use of the going concern basis of accounting in the preparation of the financial statements is appropriate.

Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the authority’s ability to continue as a going concern for a period of twelve months from when the financial statements are authorised for issue.

Our responsibilities and the responsibilities of the Director of Finance and Corporate Services with respect to going concern are described in the relevant sections of this report. However, because not all future events or conditions can be predicted, this statement is not a guarantee as to the authority’s ability to continue as a going concern.

Other information

The other information comprises the information included in the 2020/21 Pension Fund Accounts, other than the financial statements and our auditor’s report thereon. The Director of Finance and Corporate Services is responsible for the other information contained within the Statement of Accounts 2020/21.

Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in this report, we do not express any form of assurance conclusion thereon.

Our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the course of the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements themselves. If, based on the work we have performed, we conclude that there is a material misstatement of the other information, we are required to report that fact.

We have nothing to report in this regard.

Matters on which we report by exception

We report to you if:

- we issue a report in the public interest under section 24 of the Local Audit and Accountability Act 2014;

- we make written recommendations to the audited body under Section 24 of the Local Audit and Accountability Act 2014;

- we make an application to the court for a declaration that an item of account is contrary to law under Section 28 of the Local Audit and Accountability Act 2014;

- we issue an advisory notice under Section 29 of the Local Audit and Accountability Act 2014; or

- we make an application for judicial review under Section 31 of the Local Audit and Accountability Act 2014.

We have nothing to report in these respects.

Responsibility of the Director of Finance and Corporate Services

As explained more fully in the Statement of the Director of Finance and Corporate Services’ Responsibilities set out on the first page of the “Pension Fund Accounts 2020 to 2021”, the Director of Finance and Corporate Services is responsible for the preparation of the Authority’s Statement of Accounts, which includes the pension fund financial statements, in accordance with proper practices as set out in the CIPFA/LASAAC Code of Practice on Local Authority Accounting in the United Kingdom 2020/21, and for being satisfied that they give a true and fair view and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the Director of Finance and Corporate Services is responsible for assessing the Pension Fund’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the Pension Fund either intends to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

Explanation as to what extent the audit was considered capable of detecting irregularities, including fraud

Irregularities, including fraud, are instances of non-compliance with laws and regulations. We design procedures in line with our responsibilities, outlined above, to detect irregularities, including fraud. The risk of not detecting a material misstatement due to fraud is higher than the risk of not detecting one resulting from error, as fraud may involve deliberate concealment by, for example, forgery or intentional misrepresentations, or through collusion. The extent to which our procedures are capable of detecting irregularities, including fraud is detailed below. However, the primary responsibility for the prevention and detection of fraud rests with both those charged with governance of the entity and management.

We obtained an understanding of the legal and regulatory frameworks that are applicable to the Pension Fund and determined that the most significant are the Local Government Pension Scheme Regulations 2013 (as amended), and The Public Service Pensions Act 2013.

We understood how Bexley Pension Fund is complying with those frameworks by understanding the incentive, opportunities and motives for non-compliance, including inquiring of [management/head of internal audit/those charged with governance/any other] and obtaining and reading documentation relating to the procedures in place to identify, evaluate and comply with laws and regulations, and whether they are aware of instances of non-compliance. We corroborated this through our reading of the Pension Board minutes and through the inspection of other information. Based on this understanding we designed our audit procedures to identify non-compliance with such laws and regulations. Our procedures had a focus on compliance with the accounting framework through obtaining sufficient audit evidence in line with the level of risk identified and with relevant legislation.

We assessed the susceptibility of the Pension Fund’s financial statements to material misstatement, including how fraud might occur by understanding the potential incentives and opportunities for management to manipulate the financial statements, and performed procedures to understand the areas in which this would most likely arise. Based on our risk assessment procedures we identified the manipulation of journal entries of the investment asset valuations and investment income to be our fraud risk.

To address our fraud risk we tested the consistency of the investment asset valuation from the independent sources of the custodian and the fund managers to the financial statements and tested investment income through to third party evidence.

In common with all audits under ISAs (UK), we are also required to perform specific procedures to respond to the risk of management override. In addressing the risk of fraud through management override of controls, we tested the appropriateness of journal entries and other adjustments; assessed whether the judgements made in making accounting estimates are indicative of a potential bias; and evaluated the business rationale of any identified significant transactions that were unusual or outside the normal course of business.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website. This description forms part of our auditor’s report.

Use of our report

This report is made solely to the members of London Borough of Bexley, as a body, in accordance with Part 5 of the Local Audit and Accountability Act 2014 and for no other purpose, as set out in paragraph 43 of the Statement of Responsibilities of Auditors and Audited Bodies published by Public Sector Audit Appointments Limited. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the London Borough of Bexley and the London Borough fo Bexley’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Elizabeth Jackson (Key Audit Partner)

Ernst & Young LLP (Local Auditor)

Luton

Date: 9 February 2022

| 2019/20 in thousands of pounds |

Note | 2020/21 in thousands of pounds |

|

|---|---|---|---|

| (26,142) | Dealings with members, employers and others directly involved in the scheme: Contributions |

6 | (23,897) |

| (3,886) | Transfers in from other pension funds | 7 | (5,743) |

| (30,028) | Total contributions | (29,640) | |

| 32,992 | Benefits | 8 | 33,383 |

| 2,959 | Payments to and on account of leavers | 9 | 5,483 |

| 35,951 | Total benefits | 38,866 | |

| 5,923 | Sub-total: Net (additions) / withdrawals from dealings with members | 9,226 | |

| 7,670 | Management expenses | 10 | 5,376 |

| (17,231) | Returns on investments: Investment income |

11 | (12,903) |

| 27,719 | (Profit) and losses on disposal of investments and changes in value of investments | 12a | (146,791) |

| 10,448 | Net returns on investments | (159,694) | |

| 24,081 | Net (increase) / decrease in the net assets available for benefits during the year | (145,092) |

| 2019/20 in thousands of pounds |

Note | 2020/21 in thousands of pounds |

|

|---|---|---|---|

| 831,463 | Investment Assets | 12 | 897,652 |

| 16,272 | Cash Deposits | 12 | 105,321 |

| 847,735 | Total Net Investments | 1,002,973 | |

| 1,619 | Current Assets | 18 | 10,352 |

| 849,354 | Total investments and assets | 1,013,325 | |

| Long Term Liabilities | 19 | (9,195) | |

| (872) | Current Liabilities | 19 | (10,556) |

| 848,482 | Net assets of the scheme available to fund benefits at the period end | 993,574 |

The financial statements summarise the transactions of the scheme and deal with the net assets at the disposal of the Fund. They do not take account of obligations to pay pensions and benefits which fall due after the end of the scheme accounting year. The actuarial position of the scheme, which does take into account such obligations, is detailed in Note 17.

Notes to the Financial Statements

1. Introduction to the Fund

The London Borough of Bexley Pension Fund ("the Fund") is part of the Local Government Pension Scheme (LGPS). It is administered by the London Borough of Bexley under the provisions of the Superannuation Act 1972 and the subsequent detailed regulations to provide benefits for employees. These benefits include retirement and spouses' and children’s pensions, retirement and death lump-sum grants. All employees who are not eligible to join another public service scheme are eligible for membership of this scheme. Employees of other scheduled and admitted bodies also participate in this scheme.

Further details may be found in the annual report of the Fund, and in the legislation governing the LGPS.

a. General

The Fund is governed by the Public Service Pensions Act 2013. It is administered in accordance with the detailed regulations of:

- The LGPS Regulations 2013 (as amended)

- The LGPS (Transitional Provisions, Savings and Amendment) Regulations 2014 (as amended)

- The LGPS (Management and Investment of Funds) Regulations 2016 (as amended)

It is a contributory defined benefit pension scheme and operates to provide pension benefits for employees of the London Borough of Bexley and its scheduled and admitted bodies. Teachers are not included as they come within another national pension scheme. The Fund is overseen by the Pensions Committee of the London Borough of Bexley and the Local Pensions Board. Day to day responsibility for the Fund is delegated to the Statutory Section 151 Officer.

b. Membership

Membership of the LGPS is voluntary but employees are automatically enrolled when they are employed. After they start employment they have the right to opt-out. They can also make their own personal arrangements outside the scheme.

Organisations participating in the Pension Fund include:

- scheduled bodies, which are local authorities and similar bodies whose staff are automatically entitled to be members of the Fund

- admitted bodies, which are other organisations that participate in the Fund under an admission agreement between the Fund and the relevant organisation. Admitted bodies include voluntary, charitable and similar bodies or private contractors undertaking a local authority function following outsourcing to the private sector

| 31 March 2020 | 31 March 2021 | |

|---|---|---|

| 75 | Number of employers with active members | 75 |

| 2,399 | Number of employees in the Fund at London Borough of Bexley | 2,290 |

| 3,173 | Number of employees in the Fund at Other employers | 2,963 |

| 5,572 | Number of employees in the Fund in Total | 5,253 |

| 4,912 | Number of pensioners in the Fund at London Borough of Bexley | 4,891 |

| 770 | Number of pensioners in the Fund at Other employers | 866 |

| 5,682 | Number of pensioners in the Fund in Total | 5,757 |

| 3,729 | Number of deferred pensioners in the Fund at London Borough of Bexley | 3,610 |

| 1,241 | Number of deferred pensioners in the Fund at Other employers | 1,321 |

| 4,970 | Number of deferred pensioners in the Fund in Total | 4,931 |

c. Funding

In 2020/21, the Fund was financed by contributions from employers and employees and by income from investments. Employees make a contribution to the Fund at a percentage of their pensionable earnings and emoluments; this ranges from 5.5% to 12.5% depending on the level of their earnings. The employers’ contributions are in accordance with the advice of a professionally qualified actuary and have been set so that the Fund will be able to meet the cost of current and estimated future retirement benefits. The most recent valuation is in respect of 31 March 2019 and shows a funding level of 101% (2016 was 94%). This includes an estimate of the expected increase in liabilities following the McCloud court judgement. Further details on the McCloud court judgement can be found in Note 17. Whilst the Fund as a whole is fully funded the funding levels for individual employers in the fund varies with some being in a deficit position. The average deficit recovery period is ten years. Currently, Employer contribution rates range from 15.3% to 32.1%. Further details on the funding position are contained in Note 17.

d. Benefits

Prior to 1 April 2014, pension benefits under the LGPS were based on final pensionable pay and length of pensionable service, summarised in the following table.

| Benefit type | Service pre 1 April 2008 | Service post 31 March 2008 |

|---|---|---|

| Pension | Each year worked is worth 1/80 × final pensionable salary. | Each year worked is worth 1/60 × final pensionable salary. |

| Lump-sum | Automatic lump sum of 3 × pension. In addition, part of the annual pension can be exchanged for a one-off tax-free cash payment. A lump sum of £12 is paid for each £1 of pension given up. |

No automatic lump sum. Part of the annual pension can be exchanged for a one-off tax-free cash payment. A lump sum of £12 is paid for each £1 of pension given up |

From 1 April 2014, the scheme became a career average scheme, whereby members accrue benefits based on their pensionable pay in that year at an accrual rate of 1/49th. Accrued pension is adjusted annually in line with the Consumer Prices Index.

A range of other benefits is also provided including early retirement, disability pensions and death benefits, as explained on the LGPS website.

2. Basis of Preparation

The accounts have been prepared in accordance with the Code of Practice on Local Authority Accounting in the United Kingdom 2020/21 (the Code), which is based upon International Financial Reporting Standards (IFRS), as amended for the UK public sector. The accounts have been prepared on a going concern basis.

In carrying out its assessment that this basis is appropriate, made to 31 March 2023, management of the Pension Fund have considered the additional qualitative and quantitative key requirements:

- The basis for preparation is supported by legislation for local authorities, and the Code requirements on the basis of the continuation of services;

- All employers within the fund are paying contributions as per the rates and adjustment certificate.

No employer has requested to defer their payments within the 2020/21 financial year, or within 2021/22 to date.

- The Pension Fund does not have any external borrowing; and

- The Pension Fund has net assets of £1,002.972m which are assets that could be liquidated to pay benefits should the need arise. The make up of assets is included within note 12 to the accounts however includes:

- Private equity £72.672m

- Pooled Investments Vehicles £744.075m

- Pooled Property Investment £80.755m

- Cash Deposits £105.321m

On this basis, the Pension Fund have a reasonable expectation that it will have adequate resources to continue in operational existence throughout the going concern period. For this reason, alongside the statutory guidance, we continue to adopt the going concern basis in preparing these financial statements.

Conclusion

Considering the above, there are no material uncertainties that cast significant doubt upon the Pension Funds ability to continue to operate on a going concern basis to 31 March 2023.

3. Accounting Policies

a. Contribution income

Normal contributions are accounted for on an accruals basis as follows:

- employee contribution rates are set in accordance with LGPS regulations, using common percentage rates for all schemes which rise according to pensionable pay

- employer contributions are set at the percentage rate recommended by the fund actuary for the period to which they relate

Employer deficit funding contributions are accounted for on the basis advised by the Fund actuary in the rates and adjustment certificate issued to the relevant employing body. Additional employers’ contributions in respect of ill-health and early retirements are accounted for in the year the event arose.

b. Transfers to and from other schemes

Transfer values represent the amounts received and paid during the year for members who have either joined or left the Fund and are calculated in accordance with LGPS regulations. The timing of these receipts and payments depends on factors such as confirmation of instructions from members and the administrative processes of the previous/new employer. Transfer values are accounted for on a cash basis as opposed to the accrual basis used for the rest of the accounts.

c. Investment income

- Interest income

Interest income is recognised as it accrues, using the effective interest rate of the financial instrument as at the date of acquisition or origination. - Dividend income

Dividend income is accounted for on the date the shares are quoted ex-dividend. Any amounts not received by the end of the financial year are disclosed in the net asset statement as a current financial asset. - Distributions from pooled funds

Distributions from pooled funds are recognised at the date of issue. Any amounts not received by the end of the financial year are disclosed in the net asset statement as a current financial asset. - Movement in the net market value of investments

Changes in the net market value of investments are recognised as income and comprise all realised and unrealised profits/losses during the year.

d. Benefits payable

Pensions and benefits payable include all amounts due as at the end of the financial year; any amounts unpaid show as current liabilities.

e. Voluntary Scheme Pays, Mandatory Scheme Pays and lifetime allowance

Members are entitled to request the Pension Fund pays their tax liabilities due in respect of annual allowance and lifetime allowance in exchange for a reduction in pension.

Where the Fund pays member tax liabilities direct to HMRC it is treated as an expense in the year in which the payment occurs.

f. Taxation

The Fund is a registered public service scheme under Section 1(1) of Schedule 36 of the Finance Act 2004 and as such is exempt from UK income tax on interest received and from capital gains tax on the proceeds of investments sold. Income from overseas investments suffers withholding tax in the country of origin unless exemption is permitted. Irrecoverable tax is accounted for as a Fund expense as it arises. As the Council is the administering authority for the Fund, VAT input tax is recoverable on all Fund activities including expenditure on investment expenses.

g. Management expenses

The fund discloses its pension fund management expenses in accordance with the CIPFA guidance Accounting for Local Government Pension Scheme Management Expenses (2016), as shown below. All items of expenditure are charged to the Fund on an accruals basis as follows:

Administrative expenses

All administrative expenses are accounted for on an accruals basis. Costs of the external pension fund administrator and other suppliers are charged directly to the Fund, whereas internal staff, accommodation and other overhead costs are apportioned to the Fund and charged as expenses.

Oversight and governance costs

All oversight and governance expenses are accounted for on an accruals basis. All staff costs associated with governance and oversight are charged directly to the Fund. Associated management, accommodation and other overheads are apportioned to this activity and charged as expenses to the Fund.

Investment management expenses

All investment management expenses are accounted for on an accruals basis. The fees of the external investment managers are mainly based on the market value of the funds they invest and will increase or decrease with the value of their investments. Investment management expenses are charged directly to the Fund as part of management expenses and are not included in, or netted off from, the reported return on investments. Where fees are netted off quarterly valuations by the investment manager these are shown separately in Note 10a and grossed up to increase the change in the value of investments.

Where an investment manager’s fee note has not been received by the year-end date, an estimate based upon the market value of their mandate as at the end of the year is used for inclusion in the fund account. In 2020/21 £0.1m of fees is based on such estimates (2019/20: £0.1m).

Private Equity Management fees are estimated by taking a portion of the total management fees of the private equity partnership based on the percentage of the Fund holdings with the partnership. In 2020/21 £1.4m of fees is based on such estimates (2019/20: £2.7m).

Net assets statement

h. Financial assets

Financial assets are included in the net assets statement on a Fair Value basis as at the reporting date. A financial asset is recognised in the net assets statement on the date the Fund becomes party to the contractual acquisition of the asset. From this date, any gains or losses arising from changes in the Fair Value of the asset are recognised by the Fund. The values of investments as shown in the net assets statement have been determined at Fair Value in accordance with the requirements of the Code and IFRS 13 (See Note 13). For the purposes of disclosing levels of Fair Value hierarchy, the Fund has adopted the classification guidelines recommended in Practical Guidance on Investment Disclosures (PRAG/Investment Association, 2016).

i. Foreign currency transactions

Dividends, interest and purchases and sales of investments in foreign currencies have been accounted for at the spot market rates at the date of transaction. End-of-year spot market exchange rates are used to value cash balances held in foreign currency bank accounts, overseas investments and purchases and sales outstanding at the end of the reporting period.

j. Cash and cash equivalents

Cash and cash equivalents are represented by the balance on the Fund’s bank accounts together with amounts held by the Fund’s external managers and invested in Money Market Funds.

k. Financial liabilities

The Fund recognises financial liabilities at Fair Value as of the reporting date. A financial liability is recognised in the net assets statement on the date the Fund becomes party to the liability. From this date, any gains or losses arising from changes in the Fair Value of the liability are recognised by the Fund.

l. Actuarial present value of promised retirement benefits

The actuarial present value of promised retirement benefits is assessed on a triennial basis by the Fund's actuary in accordance with IAS 19 and relevant actuarial standards. As permitted under the code, the Fund has opted to disclose the actuarial present value of promised retirement benefits as a note to the net assets statement (See Note 17).

m. Additional voluntary contributions

Scheme members can also make arrangements for separate investments into their personal Additional Voluntary Contribution (AVC) accounts with an AVC provider recommended by the Fund. The Fund is only involved in collecting and paying over these amounts on behalf of scheme members and the separately invested amounts are not included in these pension fund accounts in accordance with Section 4(1)(b) of the Local Government Pension Scheme (Management and Investment of Funds) Regulations 2016. The AVC provider is Prudential and contributions are also collected for life assurance policies provided by Utmost Life and Pensions (Previously managed by Equitable Life).

n. Prepayment of Employer Contributions

Following the 2019 valuation, the London Borough of Bexley prepaid its employer contributions for 2020/21, 2021/22 and 2022/23. The remaining prepayment balance of £18.7m is shown as a liability in the 2020/21 accounts (short term £9.505m and long term £9.195m). The prepayment receipts were invested as Fund assets and are assumed by the actuary to earn similar returns to other Fund assets. The risk of the extra amounts arriving in the Fund at an inauspicious time for investment returns was mitigated by making the investments over a period of time. The treatment of these payments was set out in the actuary’s rates and adjustments certificate.

o. Contingent Assets and Contingent Liabilities

A contingent asset arises where an event has taken place giving rise to a possible asset whose existence will only be confirmed or otherwise by the occurrence of future events.

A contingent liability arises where an event has taken place prior to the year-end giving rise to a possible financial obligation whose existence will only be confirmed or otherwise by the occurrence of future events. Contingent liabilities can also arise in circumstances where a provision would be made, except that it is not possible at the balance sheet date to measure the value of the financial obligation reliably.

Contingent assets and liabilities are not recognised in the net asset statement but are disclosed by way of narrative in the notes.

4. Critical judgements in applying accounting policies

Unquoted investments

It is important to recognise the highly subjective nature of determining the fair value of private equity, infrastructure, pooled property, and private credit investments. They are inherently based on forward-looking estimates and judgements involving many factors. Unquoted investments are valued by the investment managers. Private equity and pooled property valuations are based on similar market available evidence as it has been judged that this evidence is comparable to the holdings in the Fund.

The value of unquoted private equities at 31 March 2021 was £72.7m (2019/20: £62.3m) and unquoted infrastructure at 31 March 2021 was £28.2m (2019/20: £23.1m). The value of pooled property holdings as at 31 March 2021 was £109.9m (2019/20: £98.3m). There has also been a new investment during 2020/21 in a private credit fund (totalling £50m), however this investment took place over the year end and therefore at 31 March 2021 was held as cash with the investment manager.

Pension Fund liability

The Fund liability is calculated every three years by the Fund's actuary, with annual updates in the intervening years. The methodology used is in line with accepted guidelines and in accordance with IAS 19. Assumptions underpinning the valuations are agreed with the actuary and are summarised in Note 17. This estimate is subject to significant variances based on changes to the underlying assumptions.

5. Major sources of estimation uncertainty

The preparation of financial statements requires management to make judgements, estimates and assumptions that affect the amounts reported for assets and liabilities at the balance sheet date and the amounts reported for the revenues and expenses during the year. Estimates and assumptions are made taking into account historical experience, current trends and other relevant factors. However, because amounts cannot be determined with certainty, actual results could be materially different from the assumptions and estimates.

| Item | Uncertainties | Effect if actual results differ from assumptions |

|---|---|---|

| Actuarial present value of promised retirement benefits | Estimation of the net liability to pay pensions depends on a number of complex judgements relating to the discount rate used, the rate at which salaries are projected to increase, changes in retirement ages, mortality rates and expected returns on Fund assets. The Fund employs a professional actuary to provide expert advice about the assumptions to be used. | The effects on the net pension liability of changes in individual assumptions can be measured. For example:

|

| McCloud Judgement | As a result of the McCloud judgement regarding age discrimination in the Fire Service and Judiciary pension schemes the Government is going to bring forward proposals to address the issue for other public pension schemes, including the LGPS. At this stage it is unknown what the proposals for the LGPS will be and therefore an estimation of the potential increase in liabilities has been disclosed in the accounts. | The Fund’s actuary has estimated that the cost of the judgment could be an increase in past service liabilities of broadly £7 million and an increase in the primary contribution rate of 0.7% of pensionable pay per annum. Where an employer has elected to include a provision for the cost of the judgment, this is included within the secondary rate for that employer over 2020/23 (and also within the Whole Fund average secondary rate of £1.1 million). If the actual cost of the judgement differs from the estimate this will be reflected in contribution rates at the next valuation. |

| COVID-19 | The COVID-19 pandemic has created market volatility and economic uncertainty, impacting the value of the assets in the Fund. Whilst markets have, for the most part, recovered, further developments could create additional uncertainty. For unquoted assets, such as property and private equity, the impact of Covid-19 may take longer to be fully assessed, As such, judgements have had to be made as to what the impact is on those assets which are not publicly listed. There may also be an impact on the pension liabilities in the Fund, for example if the longevity of members differs from that in the actuary’s assumptions. |

Sensitivity analysis of the valuation of unquoted assets is included in Note 13. The valuation results and employer contributions were assessed as at 31 March 2019. Employer contributions have not been revisited but the position will be kept under review by the Administering Authority who will monitor the development of the situation and keep all stakeholders informed of any potential implications so that the outcome can be managed effectively. |

| Unquoted investments | The Fund's assets include investments in unquoted assets such as property, infrastructure and private equity on a pooled basis. These assets are valued by investment managers at fair value in accordance with relevant industry standards and guidelines. Managers may use comparable market data, indices and data from third parties, as well as projected revenue, to determine the fair value of these assets. As such, there is a degree of estimation involved in these valuations. | The total value of unlisted investments in the financial statements is £210.8m (2019/20 £183.7m), as broken down below:

|

6. Contributions receivable

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 6,375 | Employees' contributions | 6,144 |

| 15,409 | Employers' contributions: Normal contributions |

15,608 |

| none | Special employer contributions | 102 |

| 4,351 | Deficit recovery contributions | 2,036 |

| 7 | Augmentation contributions | 7 |

| 19,767 | Total Employers' contributions: | 17,753 |

| 26,142 | Total contributions receivable | 23,897 |

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 14,048 | Administering Authority | 10,303 |

| 10,548 | Scheduled bodies | 11,967 |

| 1,546 | Admitted bodies | 1,627 |

| 26,142 | Total | 23,897 |

7. Transfers in from other pension funds

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 3,658 | London Borough of Bexley | 5,214 |

| 178 | Scheduled bodies | 368 |

| 49 | Admitted bodies | 161 |

| 3,886 | Total | 5,743 |

All transfers in relate to individual transfers from other schemes as there were no bulk transfers in these periods.

8. Benefits Payable

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 28,084 | Pensions | 28,720 |

| 7 | Augmented service | 7 |

| 3,875 | Commutation of pensions and lump sum retirement benefits | 4,101 |

| 1,026 | Lump sum death benefits | 554 |

| 32,992 | Total | 33,383 |

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 28,253 | London Borough of Bexley | 28,383 |

| 2,059 | Scheduled bodies | 2,372 |

| 2,680 | Admitted bodies | 2,628 |

| 32,992 | Total | 33,383 |

9. Payments to and on account of leavers

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 126 | Refunds of contributions | 107 |

| 2,833 | Individual transfers out to other schemes | 5,376 |

| 2,959 | Total | 5,483 |

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 2,335 | London Borough of Bexley | 4,892 |

| 608 | Scheduled bodies | 589 |

| 16 | Admitted bodies | 3 |

| 2,959 | Total | 5,483 |

There were no bulk transfers in 2020/21.

10. Management expenses

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 507 | Administrative costs | 503 |

| 6,614 | Investment management expenses | 4,367 |

| 549 | Oversight and governance costs | 506 |

| 7,670 | Total | 5,376 |

10 (a) Investment Management expenses

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 5,778 | Management fees | 4,292 |

| 257 | Custody and performance measurement fees | 41 |

| 579 | Transaction costs | 34 |

| 6,614 | Total | 4,367 |

In addition to these costs, indirect costs are incurred through the bid-offer spread on investment sales and purchases. These are reflected in the cost of investment acquisitions and in the proceeds from the sales of investments (See Note 12a).

The LCIV has negotiated a performance-related fee element with its global equity sub-fund manager Newton. In 2020/21 there was no net performance-related fee (£0.2m was paid by the Fund in 2019/20) and this is included in the figures above.

11. Investment income

| 2019/20 in thousands of pounds |

2020/21 in thousands of pounds |

|

|---|---|---|

| 318 | Income from Equities | 4 |

| 13,434 | Income from Pooled Investments - unit trusts and other managed funds | 10,571 |

| 603 | Private Equity Income | 550 |

| 2,818 | Pooled Property Investments | 1,744 |

| 58 | Interest on cash deposits | 34 |

| 17,231 | Total | 12,903 |

12. Investments

| 31 March 2020 in thousands of pounds |

31 March 2021 in thousands of pounds |

|

|---|---|---|

| 150 | Long term investments: Equities |

150 |

| 767,704 | Investment assets: Pooled investment vehicles |

824,830 |

| 62,257 | Private Equity | 72,672 |

| 16,272 | Cash/temporary investments | 105,321 |

| 1,352 | Investment income due | none |

| 847,735 | Total investment assets | 1,002,972 |

12 (a) Reconciliation of movements in investments

| Value at 31 March 2020 in thousands of pounds |

Purchases during the year in thousands of pounds |

Sales during the year in thousands of pounds |

Change in market value in thousands of pounds |

Value at 31 March 2021 in thousands of pounds |

|

|---|---|---|---|---|---|

| Equities | 150 | - | - | - | 150 |

| Pooled investment vehicles (LCIV) | 525,149 | 75,810 | (182,590) | 115,499 | 533,870 |

| Pooled investment vehicles (non-LCIV) | 158,426 | 46,400 | (4,032) | 9,411 | 210,205 |

| Pooled Property investment | 84,129 | 6,230 | (11,090) | 1,487 | 80,755 |

| Private Equity | 62,257 | 3,723 | (13,702) | 20,393 | 72,672 |

| Total | 830,111 | 132,164 | (211,414) | 146,791 | 897,651 |

| Other investment balance: Cash Deposits |

16,272 | 105,321 | |||

| Investment income due | 1,352 | none | |||

| Net Investment Asset | 847,735 | 1,002,972 | |||

| Current Net Assets/(Liabilities) | 747 | none | |||

| Net Asset | 848,482 | 1,002,972 |

| Value at 31 March 2019 in thousands of pounds |

Purchases during the year in thousands of pounds |

Sales during the year in thousands of pounds |

Change in market value in thousands of pounds |

Value at 31 March 2020 in thousands of pounds |

|

|---|---|---|---|---|---|

| Equities | 150 | - | - | - | 150 |

| Pooled investment vehicles (LCIV) | 541,398 | 14,382 | (2,879) | (27,752) | 525,149 |

| Pooled investment vehicles (non-LCIV) | 156,474 | 96,515 | (96,875) | 2,312 | 158,426 |

| Pooled Property investment | 91,887 | 4,186 | (9,905) | (2,039) | 84,129 |

| Private Equity | 72,181 | 4,688 | (14,372) | (240) | 62,257 |

| Total | 862,090 | 119,771 | (124,031) | (27,719) | 830,111 |

| Other investment balance: Cash Deposits |

17,064 | 16,272 | |||

| Investment income due | 2,398 | 1,352 | |||

| Net Investment Asset | 881,552 | 847,735 | |||

| Current Net Assets/(Liabilities) | (8,989) | 747 | |||

| Net Asset | 872,563 | 848,482 |

12 (b) Analysis of investments

| 31 March 2020 in thousands of pounds |

31 March 2021 in thousands of pounds |

|

|---|---|---|

| 150 | Equities: UK unquoted |

150 |

| 150 | Total equities | 150 |

| 84,129 | Pooled investment vehicles: Managed funds – UK property unquoted |

90,645 |

| 107,065 | Managed funds - UK index-linked unquoted Bonds | 153,822 |

| 28,771 | Managed funds - Overseas index-linked unquoted Equities | 40,000 |

| 84,846 | Managed funds – Overseas limited liability partnership unquoted | 89,054 |

| 268,497 | London Collective Investment Vehicle (LCIV) Pooled Sub-Funds - Global Unquoted: • Global Equity Fund |

291,614 |

| 81,323 | • Income Equity Fund | 77,376 |

| 84,329 | • Absolute Return Fund | none |

| 90,486 | • Global Bond Fund | 143,152 |

| 515 | • Infrastructure Fund | 11,837 |

| 829,961 | Total pooled investment vehicles | 897,501 |

| 16,272 | Cash/temporary investments | 105,321 |

| 1,352 | Investment income due | none |

| 17,624 | Total other | 105,321 |

| 847,735 | Total investment assets | 1,002,972 |

12 (c) Investments analysed by fund manager

| 2019 to 20, in thousands of pounds | 2019 to 20, percentage | 2020 to 21, in thousands of pounds | 2020 to 21, percentage | |

|---|---|---|---|---|

| 150 | 0 | LCIV - Shareholding | 150 | 0 |

| 268,892 | 31.7 | LCIV –Newton Global Equity Fund | 291,614 | 29.1 |

| 84,329 | 10 | LCIV – Ruffer Absolute Return Fund | none | none |

| 82,203 | 9.7 | LCIV – Epoch Income Equity Fund | 77,376 | 7.7 |

| 515 | 0.1 | LCIV – Stepstone Infrastructure Fund | 11,837 | 1.2 |

| 90,486 | 10.7 | LCIV – PIMCO Global Bond Fund | 143,152 | 14.3 |

| none | none | LCIV – Inflation Plus Fund | 9,890 | 1 |

| 526,575 | 62.2 | LCIV Sub total (London Collective Investment Vehicle) | 534,020 | 53.5 |

| 107,065 | 12.6 | BlackRock - Index linked gilt fund / corporate bond fund | 153,822 | 15.3 |

| 28,771 | 3.4 | BlackRock Equity Index Fund | 40,000 | 4.0 |

| 98,309 | 11.6 | La Salle | 100,036 | 10.0 |

| 62,257 | 7.3 | Partners Group | 72,671 | 7.2 |

| 22,590 | 2.7 | UBS infrastructure Fund | 16,383 | 1.6 |

| 168 | 0 | Cash Held at Custodian (Northern Trust) | 168 | 0 |

| none | none | Cash Held at Fund Managers (in transit) | 50,872 | 5.1 |

| 2,000 | 0.2 | LGIM Money Market Fund | 35,000 | 3.5 |

| 847,735 | 100 | Total investments | 1,002,972 | 100 |

All fund managers operating the pooled investment vehicles are registered in the UK.

The managed funds overseas unquoted limited liability partnerships are investments in funds of private equity funds, and an infrastructure fund.

The LCIV unit trusts are unquoted, however, all investments within the Global Equity, Income Equity and Global Bond sub-funds are quoted.

| Asset Class / Security Name | Manager | 31.03.21 in thousands of pounds |

31.03.21 % of inv assets |

|---|---|---|---|

| Global Equity Fund | Newton | 291,614 | 29.1 |

| Income Equity Fund | Epoch | 77,376 | 7.7 |

| Global Bond Fund | Pimco | 143,152 | 14.3 |

| Index linked gilt fund/corporate bond fund | Blackrock | 153,822 | 15.3 |

| Property | LaSalle | 100,036 | 10.0 |

| Private Equity | Partners | 72,671 | 7.2 |

| Asset Class / Security Name | Manager | 31.03.20 in thousands of pounds |

31.03.20 % of inv assets |

|---|---|---|---|

| Global Equity Fund | Newton | 268,892 | 31.7 |

| Income Equity Fund | Epoch | 82,203 | 9.7 |

| Global Bond Fund | Pimco | 90,486 | 10.7 |

| Index linked gilt fund/corporate bond fund | Blackrock | 107,065 | 12.6 |

| Property | LaSalle | 98,309 | 11.6 |

| Private Equity | Partners | 62,257 | 7.3 |

13. Fair Value – Basis of Valuation

The basis of the valuation of each class of investment asset is set out below. There has been no change in the valuation techniques used during the year. All assets have been valued using fair value techniques which represent the highest and best price available at the reporting date.

| Description of asset | Valuation hierarchy | Basis of valuation | Observable and unobservable | Key sensitivities affecting the valuations provided |

|---|---|---|---|---|

| Market quoted investments | Level 1 | Published bid market price ruling on the final day of the financial year. | Not required | Not required |

| Unquoted bonds funds | Level 2 | Average of broker prices. | Evaluated price feeds | Not required |

| Pooled LCIV – ACS* | Level 2 | Quoted investments are valued at mid-market value as at close of business on the last working day of the relevant period. Unquoted investments or if a quotation is not available at the time of valuation, the fair value shall be estimated on the basis of the probable realisation value of the investment. Collective investment schemes are valued at quoted bid prices for dual priced funds and at quoted prices for single priced funds, on the last business day of the relevant period. |

Evaluated Price Feeds | Not required |

| Pooled investments – overseas unit trusts and property funds | Level 3 | Closing bid price where bid and offer prices are published. Closing single price where single price published. | NAV-based pricing set on a forward pricing basis | Significant changes in rental growth, vacancy levels or the discounted rate could affect valuations as could more general changes to market prices. |

| Unquoted private equity | Level 3 | Comparable valuation of similar companies in accordance with International Private Equity and Venture Capital Valuation Guidelines. | EBITDA multiple Revenue multiple Discount for lack of marketability. Control premium | Valuations could be affected by material events occurring between the date of the financial statements provided and the pension fund’s own reporting date, by changes to expected cash flows, and by any differences between audited and unaudited accounts. |

| Unquoted Infrastructure Managed Funds | Level 3 | The Fair Value of the investments has been determined using valuation techniques appropriate to each investment. These techniques include discounted cash flow analysis and comparable transaction multiples in accordance with the International Private Equity and Venture Capital Valuation Guidelines. | Significant unobservable inputs and observable inflation | Valuations could be affected by material events occurring between the date of the financial statements provided and the pension fund’s own reporting date, by changes to expected cash flows, and by any differences between audited and unaudited accounts. |

| Pooled LCIV – EUUT** | Level 3 | The Fair Value of the investments has been determined using valuation techniques appropriate to each investment. These techniques include discounted cash flow analysis and comparable transaction multiples. | Significant unobservable inputs and observable inflation. | Valuations could be affected by material events occurring between the date of the financial statements provided and the pension fund’s own reporting date, by changes to expected cash flows, and by any differences between audited and unaudited accounts. |

* The term ACS refers to Authorised Contractual Scheme

** The term EUUT refers to Exempt Unauthorised Unit Trust

Sensitivity of assets valued at level 3

Having analysed historical data and current market trends, and consulted with investment managers and independent advisors, the fund has determined that the valuation methods described above are likely to be accurate to within the following ranges and has set out below the consequent potential impact on the closing value of investments held at 31 March 2021.

| Investments | Assessed valuation range (+/-) |

Value at 31/03/2021 in thousands of pounds |

Value on increase in thousands of pounds |

Value on decrease in thousands of pounds |

|---|---|---|---|---|

| Private Equity | 15% | 72,671 | 83,572 | 61,770 |

| UBS Infrastructure Fund | 15% | 16,383 | 18,841 | 13,926 |

| LCIV Infrastructure Fund | 15% | 11,837 | 13,613 | 10,062 |

| LCIV Aviva Inflation Plus | 10% | 9,890 | 10,879 | 8,901 |

| La Salle Pooled Investment Property | 10% | 80,755 | 88,831 | 72,680 |

| Total | 191,536 | 215,736 | 167,339 |

a. Fair Value Hierarchy

Asset and liability valuations have been classified into three levels, according to the quality and reliability of information used to determine fair values. Transfers between levels are recognised in the year in which they occur.

Level 1

Financial instruments at level 1 are those where the fair values are derived from unadjusted quoted prices in active markets for identical assets or liabilities. Products classified at this level comprise quoted equities, quoted fixed securities, quoted index-linked securities and quoted unit trusts.

Level 2

Financial instruments at level 2 are those where quoted market prices are not available. This may be where an instrument is traded in a market that is not considered to be active, or where valuation techniques are used to determine fair value and those techniques use inputs that are based significantly on observable market data.

Level 3

Financial instruments at level 3 are those where at least one input that could have a significant effect on the instrument's valuation is not based on observable market data.

The following table provides an analysis of the financial assets and liabilities of the Fund grouped into Levels 1 to 3, based on the level at which the fair value is observable.

| Values at 31 March 2021 | Quoted market price Level 1 in thousands of pounds |

Using Observable inputs Level 2 in thousands of pounds |

With significant unobservable inputs Level 3 in thousands of pounds |

Total in thousands of pounds |

|---|---|---|---|---|

| Financial assets at Fair Value through profit and loss | 150 | 705,965 | 191,536 | 897,651 |

| Net investment assets | 150 | 705,965 | 191,536 | 897,651 |

| Values at 31 March 2020 | Quoted market price Level 1 in thousands of pounds |

Using Observable inputs (restated) Level 2 in thousands of pounds |

With significant unobservable inputs (restated) Level 3 in thousands of pounds |

Total in thousands of pounds |

|---|---|---|---|---|

| Financial assets at Fair Value through profit and loss | 150 | 660,471 | 169,490 | 830,111 |

| Net investment assets | 150 | 660,471 | 169,490 | 830,111 |

| 2020/21 | Market Value 01/04/2020 in thousands of pounds | Purchases during the year and derivative movements in thousands of pounds | Sales during the year and derivative receipts in thousands of pounds | Unrealised gains/ (losses) in thousands of pounds | Realised gains/ (losses) in thousands of pounds | Market Value 31/03/2021 in thousands of pounds |

|---|---|---|---|---|---|---|

| UBS Infrastructure Fund | 22,590 | none | (4,032) | (2,175) | none | 16,383 |

| LCIV Infrastructure Fund | 515 | 11,932 | (46) | (563) | none | 11,837 |

| LCIV Aviva Inflation Plus | none | 10,535 | (2) | (643) | none | 9,890 |

| Private equity | 62,256 | 3,723 | (13,702) | 13,169 | 7,225 | 72,671 |

| LCIV La Salle Pooled Investment Property | 84,129 | 6,230 | (11,090) | 308 | 1,179 | 80,755 |

| Total | 169,490 | 32,419 | (28,873) | 10,096 | 8,404 | 191,536 |

Unrealised and realised gains and losses are recognised in the profit and losses on disposal and changes in the market value of investments line of the fund account.

14. Financial Instruments

The following table analyses the carrying amounts of financial assets and liabilities (excluding cash) by category and Net Assets Statement heading.

| Fair Value through profit and loss 2019 to 20, in thousands of pounds |

Assets at amortised cost 2019 to 20, in thousands of pounds |

Financial liabilities at amortised cost 2019 to 20, in thousands of pounds |

Fair Value through profit and loss 2020 to 21, in thousands of pounds |

Assets at amortised cost 2020 to 21, in thousands of pounds |

Financial liabilities at amortised cost 2020 to 21, in thousands of pounds |

|

|---|---|---|---|---|---|---|

| 150 | Financial Assets: Equities |

150 | ||||

| 197,746 | Pooled investment vehicles (non bond) | 209,809 | ||||

| 525,150 | Pooled investment vehicles (LCIV) | 533,870 | ||||

| 107,065 | Pooled investment vehicles (bond) | 153,822 | ||||

| 16,812 | Cash | 114,370 | ||||

| 1,352 | Other investment balances | |||||

| 1,079 | Debtors | 1,303 | ||||

| (872) | Financial Liabilities Creditors |

(19,751) | ||||

| 831,463 | 17,891 | (872) | Total | 897,651 | 115,673 | (19,751) |

14 (a) Net gains and (losses) on financial instruments

| 2019 to 20, in thousands of pounds | Financial Assets | 2020 to 21, in thousands of pounds |

|---|---|---|

| (27,719) | Fair Value through profit or loss | 146,791 |

15. Nature and Extent of Risks Arising from Financial Instruments

The financial instruments used by the Fund involve a variety of financial risks:

(a) Market risk

Market risk is the risk that the fair value of a financial instrument will fluctuate because of movements in market prices. To mitigate market risk, the Committee and its investment /advisors undertake regular monitoring of market conditions and benchmark analysis. Market risk may be sub-divided into interest rate risk, price risk and currency risk, although these are to some extent inter-linked.

- interest rates may vary which will impact on the valuation of fixed interest holdings. The coupon and the duration of such investments will be spread to minimise this risk

- currency risk is the risk that the value of financial instruments will vary with the foreign exchange rate of pounds sterling. This particularly affects the Fund’s holdings in overseas equities, private equity and infrastructure. This is mitigated by the spread of investments across different countries and consideration given to hedging the risk where it is thought necessary

- prices of equity and other investments will vary as the prices on the stock exchange respond to factors specific to particular stocks or factors affecting stock markets as a whole. This is mitigated by having a diverse portfolio of investments across different managers, asset classes, countries and industries

The tables below demonstrate the potential change in net assets available following movements in market risk. The percentage used for the movement in price is based on ten-year volatility assumptions for each asset class and is, therefore, more forward-looking and informative.

| Risks | Asset Type | Market Value 31 March 2021 in millions of pounds |

% movement | Movement on Increased Value 2021 in millions of pounds |

Movement on Decreased Value 2021 in millions of pounds |

|---|---|---|---|---|---|

| Interest rate | Global Bonds (Investment Grade Credit) | 143.15 | 5.1 | 150.45 | 135.85 |

| Interest rate | UK Bonds (Investment Grade Credit) | 9.89 | 7.4 | 10.62 | 9.15 |

| Interest rate | UK Bonds (Gilts) | 143.90 | 8.2 | 155.70 | 132.10 |

| Currency, Price | Global Equities | 409.53 | 20.0 | 491.44 | 327.63 |

| Currency, Price | Private Equity | 72.67 | 28.3 | 93.24 | 52.10 |

| Currency, Price | Infrastructure | 28.61 | 18.6 | 33.93 | 23.29 |

| Price | UK Property | 90.64 | 12.5 | 101.97 | 79.31 |

| Interest rate, currency | Private Credit* | 50.00 | 4.8 | 52.40 | 47.60 |

* Although the private credit investment was held in cash at 31 March 2021, the % movement shown reflects the forward-looking volatility assumption assuming this was fully invested

| Risk | Asset Type | Market Value 31 March 2020 in millions of pounds |

% movement | Movement on Increased Value 2020 in millions of pounds |

Movement on Decreased Value 2020 in millions of pounds |

|---|---|---|---|---|---|

| Interest rate | Global Bonds (Investment Grade Credit) | 90.49 | 5.5 | 95.46 | 85.51 |

| Interest rate | UK Bonds (Investment Grade Credit) | 9.29 | 9 | 10.12 | 8.45 |

| Interest rate | UK Bonds (Gilts) | 97.78 | 10.5 | 108.05 | 87.51 |

| Currency, Price | Global Equities | 378.74 | 20.0 | 454.49 | 302.99 |

| Currency, Price | Private Equity | 62.26 | 28.5 | 80 | 44.51 |

| Currency, Price | Infrastructure | 23.11 | 18.5 | 27.38 | 18.83 |

| Price | UK Property | 90.64 | 12.5 | 101.97 | 79.31 |

| Price | Absolute Return Fund | 84.33 | 9.5 | 92.34 | 76.32 |

(b) Credit risk

Credit risk is the risk that counterparties to the financial instruments will fail to pay the amounts due to the Fund, thereby causing financial loss. This may arise if the value of a particular stock falls substantially or if a dividend is not paid out. Investment managers will usually assess this risk when making investments on behalf of the Fund. The market price of investments generally also includes a credit assessment and risk of loss into the valuations. In essence, therefore, the Fund's entire investment portfolio is exposed to some form of credit risk. There is a higher credit risk involved in the Fund’s allocation to private equity (6.9% at 31 March 2021 and 7.3% at 31 March 2020) but this risk is accepted as a trade off for potentially higher returns.

The selection of high-quality fund managers, counterparties, brokers and financial institutions minimises credit risk that may occur through the failure to settle a transaction in a timely manner. The Fund sets an annual treasury management policy for its investment of cash flow balances and deposits are not made unless they meet the credit criteria set. The table below details the Fund's cash holding under its treasury management arrangements.

| Balance as at 31 March 2020 in thousands of pounds |

Balance as at 31 March 2021 in thousands of pounds |

|

|---|---|---|

| 540 | Bank Account: Natwest Account |

9,049 |

| 2,000 | Money Market Fund: LGIM Money Market Fund |

35,000 |

| 2,540 | Total | 44,049 |

Credit risk may also occur if an employing body not supported by the central government does not pay contributions promptly, or defaults on its obligations. To mitigate this risk, the Fund regularly monitors the state of employers in the fund.

(c) Liquidity risk

Liquidity risk is the risk that the Fund might not be able to meet its payment obligations as they fall due (such as pension payments to members). The 2020/21 accounts show that the benefits and administrative expenses paid out exceeded the contributions to the Fund. The balance was met from investment income. However, the majority of the Fund’s investments were sufficiently liquid as to be sold to provide additional cash if required. The Fund operates its own separate bank account and the liquidity position is monitored on a day to day basis. The Fund is also permitted to borrow for up to 90 days if its cash flow is insufficient to meet short term commitments.

The Fund defines liquid assets as those that can be easily converted to cash within three months. Illiquid assets are those assets that will take longer than three months to convert to cash. As at 31 March 2021 the value of illiquid assets was £191.5m, which represented 19% of total fund assets (31 March 2020: £169m which represented 20% of total fund assets).

16. Funding Arrangements

The Fund's actuary carries out a funding valuation every three years to set employer contribution rates for the following triennial period. The last such valuation took place as of 31 March 2019.

The key elements of the funding policy are to:

- enable employer contribution rates to be kept as nearly constant as possible and at reasonable cost to the taxpayers, scheduled and admitted bodies

- manage employers' liabilities effectively

- ensure that sufficient resources are available to meet all liabilities as they fall due, and

- maximise the likelihood of reaching 100% funding on an ongoing basis over the next three valuation periods subject to an acceptable level of downside risk

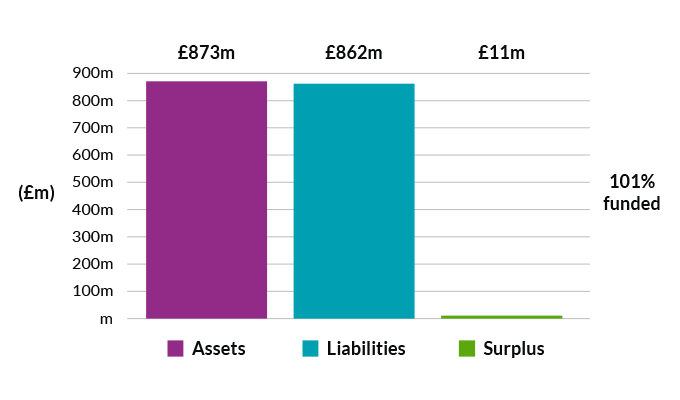

At the 2019 actuarial valuation the Fund was assessed as 101% funded (94% at the March 2016 valuation). This represented a surplus of £11m (£45m deficit in 2016) at that time. Contribution rates were set for the three year period ending 31 March 2023 for scheme employers and admitted bodies. The primary contribution rate (the rate which all employers in the Fund pay) was set at 18.5% (16.4% in 2016).

Individual employers' rates vary from the primary contribution rate depending on the demographic and actuarial factors particular to each employer. Full details of the contribution rates payable can be found in the 2019 actuarial valuation report on the Fund's website.

17. Actuarial Present Value of Promised Retirement Benefits

The actuary's statement for the year is shown below:

London Borough of Bexley Pension Fund

Accounts for the year ended 31 March 2021 - Statement by The Consulting Actuary

This statement has been provided to meet the requirements under Regulation 57(1)(d) of The Local Government Pension Scheme Regulations 2013.

An actuarial valuation of the London Borough Of Bexley Pension Fund was carried out as at 31 March 2019 to determine the contribution rates with effect from 1 April 2020 to 31 March 2023.

On the basis of the assumptions adopted, the Fund’s assets of £873 million represented 101% of the Fund’s past service liabilities of £862 million (the “Solvency Funding Target”) at the valuation date. The surplus at the valuation was, therefore, £11 million.

The valuation also showed that a Primary contribution rate of 18.5% of pensionable pay per annum was required from employers. The Primary rate is calculated as being sufficient, together with contributions paid by members, to meet all liabilities arising in respect of service after the valuation date.

The funding objective as set out in the FSS is to achieve and maintain a solvency funding level of 100% of liabilities (the solvency funding target). In line with the FSS, where a shortfall exists at the effective date of the valuation a deficit recovery plan will be put in place which requires additional contributions to correct the shortfall. Equally, where there is a surplus it is usually appropriate to offset this against contributions for future service, in which case contribution reductions will be put in place to allow for this.

The FSS sets out the process for determining the recovery plan in respect of each employer. At this actuarial valuation the average recovery period adopted is 10 years, and the total initial recovery payment (the “Secondary rate” for 2020-2023) is an addition of approximately £1.1 million per annum on average in £ terms (which allows for the contribution plans which have been set for individual employers under the provisions of the FSS) although this varies year on year.

Further details regarding the results of the valuation are contained in the formal report on the actuarial valuation dated 31 March 2020.

In practice, each individual employer’s position is assessed separately and the contributions required are set out in the report. In addition to the certified contribution rates, payments to cover additional liabilities arising from early retirements (other than ill-health retirements) will be made to the Fund by the employers.

The funding plan adopted in assessing the contributions for each individual employer is in accordance with the Funding Strategy Statement (FSS). Any different approaches adopted, e.g. with regard to the implementation of contribution increases and deficit recovery periods, are as determined through the FSS consultation process. The valuation was carried out using the projected unit actuarial method and the main actuarial assumptions used for assessing the Solvency Funding Target and the Primary rate of contribution were as follows:

| Rates | For past service liabilities (Solvency Funding Target) | For future service liabilities (Primary rate of contribution) |

|---|---|---|

| Rate of return on investments (discount rate) | 3.65% per annum | 4.40% per annum |

| Rate of pay increases (long term)* | 3.90% per annum | 3.90% per annum |

| Rate of increases in pensions in payment (in excess of GMP) | 2.40% per annum | 2.40% per annum |

* For certain employers, as agreed with the Administering Authority, allowance was also made for short-term public sector pay restraint over a 4 year period.

The assets were assessed at market value.

The next triennial actuarial valuation of the Fund is due as of 31 March 2022. Based on the results of this valuation, the contribution rates payable by the individual employers will be revised with effect from 1 April 2023.

The McCloud Judgment

The “McCloud judgment” refers to a legal challenge in relation to historic benefit changes for all public sector schemes being age discriminatory. The Government has accepted that remedies are required for all public sector pension schemes and a consultation was issued in July 2020 including a proposed remedy for the LGPS. The key feature of the proposed remedy was to extend the final salary underpin to a wider group of members for service up to 31 March 2022. This applies to all members who were active on or before 31 March 2012 and who either remain active or left service after 1 April 2014.

In line with guidance issued by the LGPS Scheme Advisory Board, the above funding level and Primary contribution rate do not include an allowance for the estimated cost of the McCloud judgment. However, at the overall Fund level we estimate that the cost of the judgment could be an increase in past service liabilities of broadly £7 million and an increase in the Primary Contribution rate of 0.7% of Pensionable Pay per annum. Where an employer has elected to include a provision for the cost of the judgment, this is included within the secondary rate for that employer over 2020/23 (and also within the Whole Fund average secondary rate of £1.1 million per annum shown above).

Impact of Covid 19

The valuation results and employer contributions above were assessed as at 31 March 2019. In 2020 and 2021 we have so far seen significant volatility and uncertainty in markets around the world in relation to the COVID-19 pandemic. This potentially has far-reaching consequences in terms of funding and risk, which will need to be kept under review. We believe that it is important to take stock of the situation as opposed to make immediate decisions in what is an unprecedented set of events. Our view is that employer contributions should not be revisited as a general rule but the Administering Authority will be consulting on updates to the Funding Strategy Statement which will allow the Fund to review contributions between valuations where there is a material change in employer covenant or liabilities, in line with the new regulations on contribution flexibilities introduced in September 2020. The position will be kept under review by the Administering Authority who will monitor the development of the situation and keep all stakeholders informed of any potential implications so that the outcome can be managed effectively.

Actuarial Present Value of Promised Retirement Benefits for the Purposes of IAS 26

IAS 26 requires the present value of the Fund’s promised retirement benefits to be disclosed, and for this purpose the actuarial assumptions and methodology used should be based on IAS 19 rather than the assumptions and methodology used for funding purposes.

To assess the value of the benefits on this basis, we have used the following financial assumptions as at 31 March 2021 (the 31 March 2020 assumptions are included for comparison):

| Rates | 31 March 2020 | 31 March 2021 |

|---|---|---|

| Rate of return on investments (discount rate) | 2.4% per annum | 2.1% per annum |

| Rate of CPI Inflation / CARE benefit revaluation | 2.1% per annum | 2.7% per annum |

| Rate of pay increases* | 3.6% per annum | 4.2% per annum |

| Rate of increases in pensions in payment (in excess of GMP) / Deferred revaluation | 2.2% per annum | 2.8% per annum |

* This is the long-term assumption. An allowance corresponding to that made at the latest formal actuarial valuation for short-term public sector pay restraint was also included.

The demographic assumptions are the same as those used for funding purposes. Full details of these assumptions are set out in the formal report on the actuarial valuation dated March 2020.

During the year corporate bond yields decreased, resulting in a lower discount rate being used for IAS26 purposes at the year-end than at the beginning of the year (2.1% p.a. vs 2.4% p.a.). In addition, the expected long-term rate of CPI inflation increased during the year, from 2.1% p.a. to 2.7% p.a. Both of these factors served to increase the liabilities over the year.

The value of the Fund’s promised retirement benefits for the purposes of IAS 26 as of 31 March 2020 was estimated as £1,082 million including the potential impact of the McCloud Judgment.

Interest over the year increased the liabilities by c£26 million, and allowing for net benefits accrued/paid over the period also increased the liabilities by c£2 million (this includes any increase in liabilities arising as a result of early retirements/augmentations). There was also an increase in liabilities of £143 million due to “actuarial losses” (i.e. the effects of the changes in the actuarial assumptions used, referred to above, offset to a small extent by the fact that the 2021 pension increase award was less than assumed).

The net effect of all the above is that the estimated total value of the Fund’s promised retirement benefits as of 31 March 2021 is therefore £1,253 million.

GMP Indexation

The public service schemes are required to provide full CPI pension increases on GMP benefits for members who reach State Pension Age between 6 April 2016 and 5 April 2021. The UK Government has recently confirmed that it will extend this to include members reaching State Pension Age from 6 April 2021 onwards. This will give rise to a further cost to the LGPS and its employers, and an estimation of this cost was included within the IAS26 liabilities calculated last year and is again included in the overall liability figure above.

Michelle Doman

Fellow of the Institute and Faculty of Actuaries

Paul Middleman

Fellow of the Institute and Faculty of Actuaries

Mercer Limited

18. Current Assets

| 31 March 2020 in thousands of pounds |

Debtors | 31 March 2021 in thousands of pounds |

|---|---|---|

| 204 | Contributions due - employees | 222 |

| 622 | Contributions due - employers | 754 |

| 826 | Total contributions | 976 |

| 253 | Sundry debtors | 327 |

| 1,079 | Total | 1,303 |

| 540 | Cash balances | 9,049 |

| 1,619 | Total | 10,352 |

19. Current and Long Term Liabilities

| 31 March 2020 in thousands of pounds |

Liabilities | 31 March 2021 in thousands of pounds |

|---|---|---|

| (510) | Sundry creditors | (724) |

| (64) | Benefits payable | (5) |

| (298) | Accrued expenses | (323) |

| none | Employer contributions prepayments | (9,505) |

| (872) | Total | (10,556) |

| 31 March 2020 in thousands of pounds |

Liabilities | 31 March 2021 in thousands of pounds |

|---|---|---|

| none | Employer contributions prepayments | (9,195) |

| none | Total | (9,195) |

20. Additional Voluntary Contributions

| Market Value 31 March 2020 in thousands of pounds |

Market Value 31 March 2021 in thousands of pounds |

|

|---|---|---|

| 937 | Value of funds at end of year | 937* |

Additional voluntary contributions of £0.2m were paid during the year (2019/20: £0.2m).

In accordance with Regulation 4(1)(b) of the Pension Scheme (Management and Investment of Funds) Regulations 2016, the contributions paid and the assets of these investments are not included in the Fund’s Accounts.

* The main pension provider of AVC investments has not yet provided an update of the market value of funds as of 31 March 2021.

21. Related Party Transactions

As the London Borough of Bexley administers and is the largest employer of members in, the Fund there is a strong relationship between the Council and the Fund

Information in respect of material transactions with related parties is disclosed elsewhere within the Fund accounts. Of particular note is the £362,918 recharge in 2020/21 from the London Borough of Bexley to the Fund included in administration and oversight and governance costs. (£345,710 in 2019/20).

The Director of Finance and Corporate Services allocates 5% of their time to the Fund and is the only officer that is regarded as holding a key management post in respect of the Fund. In 2020/21 costs relating to the Director of Finance post totalled £9,534 in respect of the allocation to the Fund (£8,888 in 2019/20). This includes employer pension fund contributions of £1,254 (£1,322 in 2019/20). The Director of Finance contributes 11.4% of their gross salary to the LGPS in employee contributions.